Exploring Telematics Opportunities and it's Potential Growth in India

With a population of 1.38 billion, India is one of the fastest growing economies in the world. The vehicle telematics market in India is an emerging industry and is poised to grow at a rapid pace. A survey from Tech Mahindra showed that 90% of four-wheeler consumers prefer buying a vehicle with telematics capabilities. More data driven use cases such as predictive maintenance and workshop appointment scheduling, asset productivity and fleet utilisation. Consumers and fleet owners are looking for more powerful insights on the edge, providing vehicle health and performance intelligence through the data.

Through the challenges faced due to the pandemic, automotive market in India have registered negative growth in sales of all vehicle categories in FY21. However, at present, there has been increase. Also, telematics market is more focused in commercial vehicle applications such as forklifts, tractors and heavy-duty trucks which promises to be an interesting proposition for TSPs in India.

Through the challenges faced due to the pandemic, automotive market in India have registered negative growth in sales of all vehicle categories in FY21. However, at present, there has been increase. Also, telematics market is more focused in commercial vehicle applications such as forklifts, tractors and heavy-duty trucks which promises to be an interesting proposition for TSPs in India.

Commercial Viability and the rising opportunities for Telematics Providers in India

A connected ecosystem is key to driving growth in the telematics market. The coming together of various stakeholders such as OEMs, cloud infrastructure providers, telecom operators and fleet owners is the foundation for a successful telematics program. In India, there is a growing focus on building the ecosystem which makes it commercially promising for the telematics hardware and service providers.

Various government regulations such as AIS-140 and the need for tracking vehicles, is a bright path ahead for telematics offerings. With increased awareness and adoption rates, the Indian telematics market is full of growth. According to “Indian Connected Trucks Telematics Market”, telematics market in India is expected to grow at 25% rate over the years. The scope of commercial fleets ranges from transport and logistics, oil and gas, construction, utilities, service and maintenance, and retail and delivery, with transport, logistics, oil and gas segments offering highest growth. Mandates such as the ELD Mandate by the governments in North America and Canada, where the driving hours of commercial vehicles are regulated by a set of rules is an example of how government mandates increase the value for telematics providers in the market.

A growth in the adoption of electric vehicles is an interesting opportunity for telematics value providers. Telematics is important in the EV industry due to a few key analytic reports as below:

- Charging Analytics and EV Energy Usage: Telematics can help monitoring the charge level, battery health and provide valuable data required to improve the vehicle algorithms. Continuous updates and advancements on charging time, battery size and weight are being taken up by EV manufacturers.

- Fleet Management and route mapping: A lot of last mile delivery trucks are now powered through batteries. Field service managers can work through an effective route management, benchmark vehicle utilization and measure whether their plans of reducing costs and emissions.

- Firmware Update: With continuous advancements on the charging algorithms and software of an electric vehicle, TSPs can provision for firmware updates of the EV Software.

In addition to legacy GPS Tracking, there are more attractive opportunities such as more data driven usage-based insurance (UBI), fleet maintenance, route scheduling of fleet and driver insights. This allows the organisations to increase value of their offerings, thereby increasing their total market cap.

Telematics in Vehicle After-Market

Ever evolving use cases do not offer a stiff business timeline, however, it is important for the service providers to make a modular and agnostic platform which can be used in applications ranging from passenger vehicles tracking through monitoring efficiency of electric tractors.

It is required for the companies to work with various OEM on their telematics roadmap and build their value proposition. TSPs need to work with tandem in OEM on building their telematics product, since every OEM has their individual requirements based on the car architecture, privacy requirements, analytics, regional go-to-market strategies.

Vehicles are also transitioning more to a Software Defined Car, where new connectivity, automation, and personalization features will be increasingly implemented with software in the future. Therefore, our belief is that there is significant potential and value for the telematics play in the long term, provided companies are willing to rapidly evolve and adapt to new business models and opportunities.

Telematics Hardware for vehicle telematics aftermarket

iWave enables telematics service providers and connected mobility companies with rugged and reliable telematics hardware. We design and manufacture telematics control units, telematics gateway and V2X Connectivity Solutions to cater to the growing telematics applications.

The telematic gateway and telematics control unit is fit with 4 CAN Interfaces and a plethora of wired interfaces such as RS485, RS232 and analog inputs, finding a fit into different telematics and connected vehicle applications. With multiple wireless connectivity options such as 4G, Wi-Fi and Bluetooth, the gateway can power advanced telematics applications while bringing intelligence to the edge.

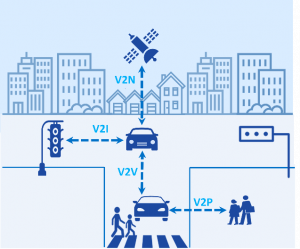

The V2X Hub is designed to enable the connect between Smart Cities and Connected Mobility. Integrated with C-V2X and DSRC technologies, the hybrid V2X Connectivity hub can be positioned as an On-Board Unit within the vehicles, as well as a Road-Side Unit to fit into external infrastructure.

Way Forward for Telematics Service Providers

Soon, we can expect car manufacturers to continue advancing vehicle connectivity by further integrating smart features into telematics systems and adding functions that improve safety like emergency services, location tracking and vehicle diagnostics.

As we become accustomed to using these services and place a high value on them, it may not be long before vehicle telematics becomes a major point of consideration when we are shopping for a new vehicle or monitoring an older one. All these applications require fast data transmission, analysis, and implementation which stretches the opportunities for telematics service providers (TSPs).

Though there has been a change in vehicle architecture, the telematics value and ecosystem is poised to play an important role in the software defined vehicle. Therefore, it is equally important for the organisations to play a prominent role in building the ecosystem, upgrade their offerings to evolving data driven use cases and adapt to the different business models.

To get in touch with iWave for enquiries and any further information, you can reach us at mktg@iwavesystems.com.

Learn more at:

Keep Reading

|  |  |

| The importance of telematics in Electric Vehicles | How V2X technology can transform your driving experience | Telematics Gateway with J1939 Data Logging for Off-Road Vehicles |